Tight Supply in Several Markets

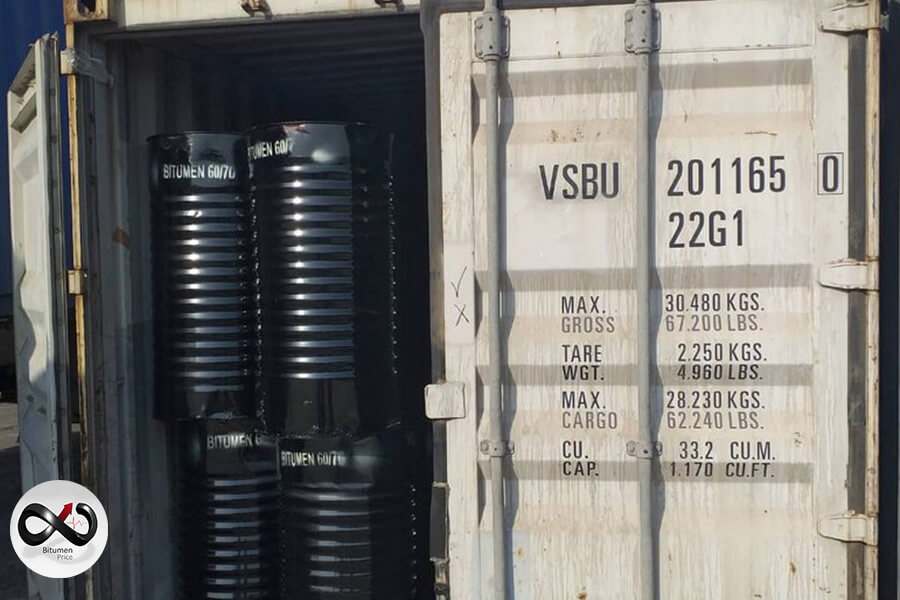

The bitumen market and petrochemicals were still volatile similar to the former weeks. In the Middle East, bitumen prices decreased by about $ 10 – $ 15 during the week. The bulk bitumen is currently volatile in the range of $ 420 – $ 430 and the new steel drum is fluctuating in the range of $ 480 – $ 490 per barrel.

On the other hand, Low production is increasing the price of several petrochemicals. Caustic soda and recycled oil have been increasing due to the shortage of raw materials and supply issues. Refineries are shifting their production toward fuels because they can find more profit due to the rising prices.

Embargoes in the west have not brought Russia’s oil import to zero but it has reduced the cargoes. Russia is trying to replace the jeopardized market of the west with the new emerging markets in Asia. However, the storage is overflowing and is full. The Russian refineries might slow down their production to resist the loss.

On the other side of the market, China has put more pressure on Russian refineries due to the rising Covid rates. China is the biggest buyer of petrochemicals and oil in the world. The country, however, is showing weaker demand compared to the 2022 vision. The preparation for the reopening of Shanghai has brought some hope to the market on the demand side of China.

The market is highly complicated and new events add up to the complexity every day. Concern factors are growing and it has become more difficult to anticipate the future. Bitumen market volatility is troubling traders but there are still experts and suppliers who navigate the changes closely to prepare the most valid report for short-term outlooks. Consult with trustworthy suppliers of the market before any decisions.