This week, the bitumen market saw slow demand across the Middle East due to the Lunar New Year holidays and extended construction breaks, particularly in Malaysia, Indonesia, and Vietnam. Iran faced falling prices, weakened by poor import demand and currency devaluation, though China’s strong purchasing offered some support. In Iraq, exports were limited as producers prioritized other products.

Malaysia

The Lunar New Year Holiday was the first reason for Malaysia’s decrease in demand. Temporarily, Many construction companies have paused since they are on an extended break, and this situation will continue until March. Because of these holidays, there is expected to be lower demand in the next week.

Indonesia

Public holidays from 27 to 29 January in Indonesia negatively affected consumption.

Vietnam

Demand in Vietnam was also slow because of the Tet holidays ahead. Trading in north Vietnam is dampened since participants celebrate the first days of spring. Construction companies will not be working till the end of February. Participants expect that low demand will continue even in the next month.

Bahrain

Bahrain prices remained at $395 per ton. Demand for Bahrain was limited, and it was only for special projects.

Iran

Bitumen bulk prices fell lower in Iran. Poor import demand from India and the weakness of the Iranian rial against the US dollar worsened the situation. Most importers slowed their activity to evaluate Trump’s actions around further sanctions on Iran. Port closures were also another reason.

On the other hand, demand was strong from China. At least 11,000 tons of jumbo bags were sold at $365-375 per ton fob for March delivery.

Iraq

In Iraq, producers sold 5,000 tons of penetration 60/70 and VG30 drummed cargo at $354-362 per ton. Exports from southern Iraq were limited, and producers focused on prioritizing HSFO exports instead.

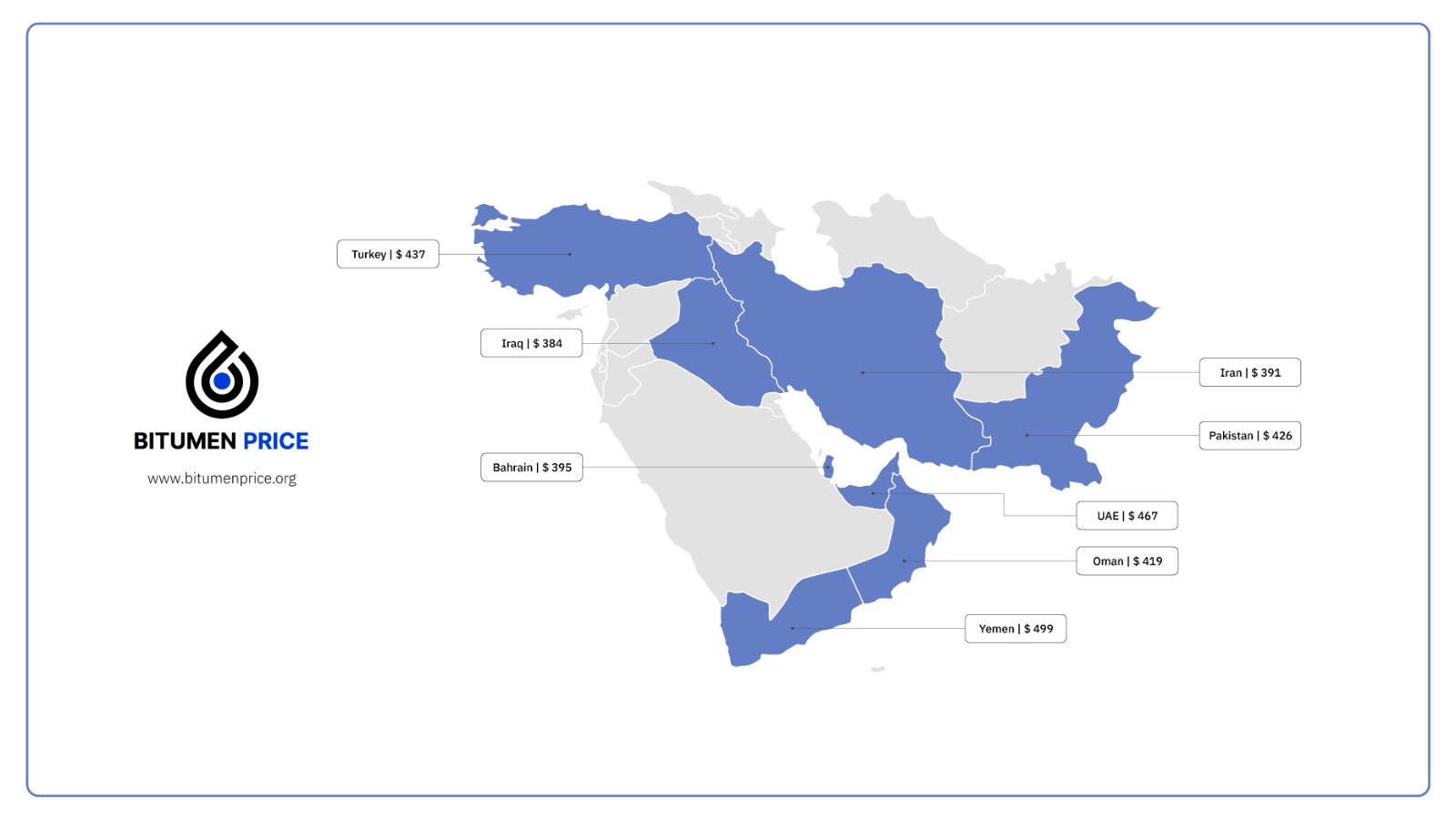

Middle East Bitumen Price

Stay informed with our weekly updates to navigate market changes effectively. For detailed insights or inquiries, reach out to our team today.