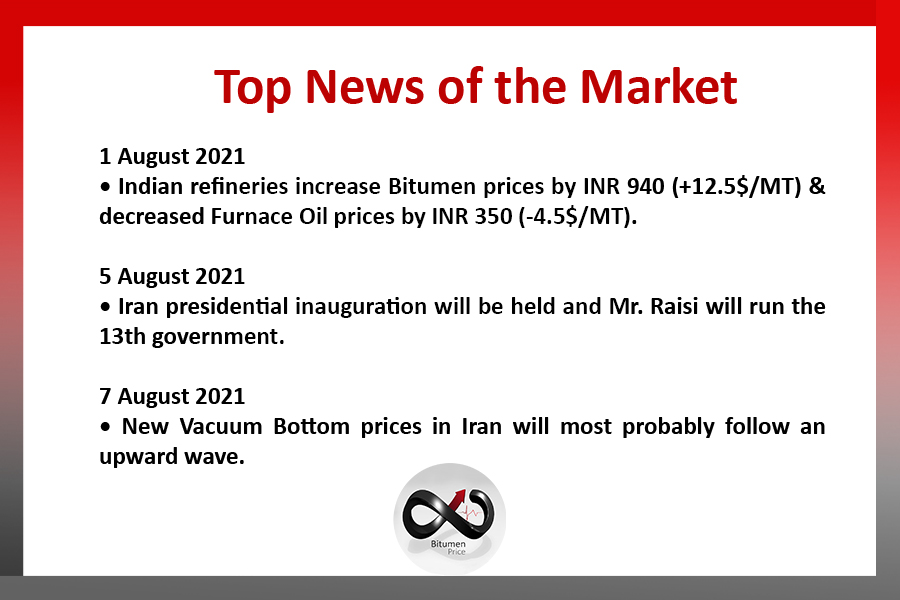

1 August 2021

- Indian refineries increase Bitumen prices by INR 940 (+12.$5/MT) & decreased Furnace Oil prices by INR 350 (-4.$5/MT).

5 August 2021

- Iran presidential inauguration will be held and Mr. Raisi will run the 13th government.

7 August 2021

- New Vacuum Bottom prices in Iran will most probably follow an upward wave.

Forecast for 2021

OPEC estimates that oil demand will fall by an average of 9.77 million barrels

per day by 2020, at 90 million barrels per day. Meanwhile, the International Energy Agency estimates that demand in 2020 was 9.2 million barrels per day. OPEC and the agency predict that demand will increase by 5.5 to

5.7 million barrels per day in 2021, but will still end the year at a lower level than before the corona outbreak.

Recently, Reuters reported in its latest 2020 poll of 39 industry experts that

one should not expect too much price growth next year. The mutation of the coronavirus and the delay of several months in the vaccine’s effect on

freedom of movement, and consequently the increase in fuel demand and

oil prices, are likely to prevent the growth or limited reduction

of black gold prices in the early months of this year.

Experts at Reuters said they expect Brent to average $50.67 a barrel in 2021

and US crude at $47.45 a barrel. To be more specific, oil prices are likely to

rise in the coming months. Just a few days ago, investment company

Meglan Capital predicted that high demand and, of course, inflation

and shareholder pressure on the largest oil companies to reduce

greenhouse gas emissions could lead to an oil supply crisis and

prices above $100 for the next three years.

In this regard, the heads of some of the world’s largest oil companies

have recently announced the continuation of the upward trend in oil prices,

due to lack of investment and limited supply of black gold in the future. Accordingly, CEOs of Royal Dutch Shell and Total have joined

commodity-trading companies and investment banks that

predict oil prices could rise as high as $100 a barrel.