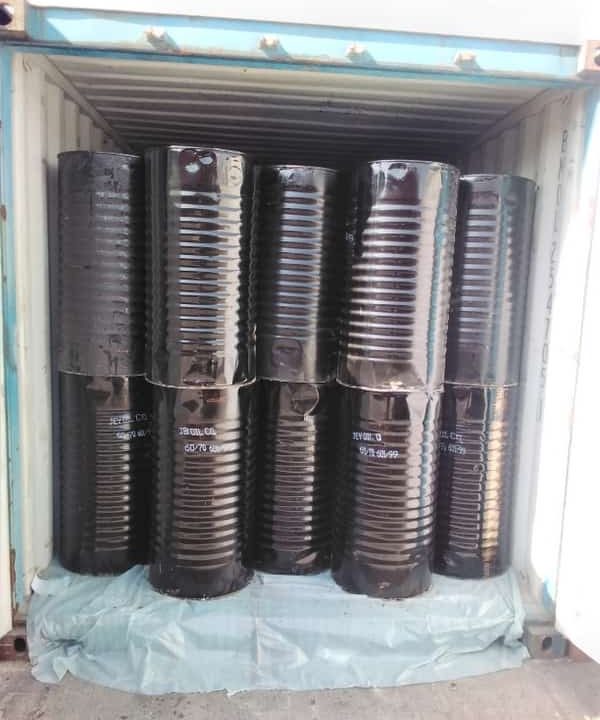

buy bitumen 80/100

As we all know, Covid-19 virus quarantine and long-term disruptions have halted development activities and buy bitumen 80/100 around the world, which

undoubtedly delays the start-up and operation of these projects and changes the schedule for the opening of these projects.Moreover, investments in the

early stages of these development projects target

and the current situation and doubts about market growth continue.

Strategies of companies to buy bitumen 80/100 in 2021

Companies are creating new investment strategies in new projects, conditions

that can change their investment plans. To be more specific, the investment plan for the Ethan Crocker

project of the Thai company PTTG in the Belmont region of the United States and the CPC project in Orange County in the United States have been challenged

as companies closely monitor global economic developments.It’s worth mentioning that initial

project investment plans are at high risk following concerns about oversupply and falling global crude oil prices.

Respectively, most of the world’s economies must continue to follow the strict measures

and quarantine of governments, and these conditions will lead to a sharp decline in demand for petrochemical products by 2020.It’s also good to know that the

impact of the Covid-19 virus outbreak crisis on the petrochemical industry will vary across the value chain,

with large end-users such as the automotive and construction industries having a great impact.However, demand from the packaging and medical equipment industries for

personal protection has helped keep the industry afloat.

What will happen for ” buy bitumen 80/100” and the oil market in the US in 2021

Citigroup, an American financial services company, predicts that oil prices will reach $

60 a barrel by the end of next year, as the market’s surplus will disappear by then. Moreover, Ed Morse,

Citibank’s global director of commodity research, said in an interview that emerging economies

would push global oil demand back to pre-Corona levels by late 2021. On the other hand, Goldman Sachs expects Brent crude to reach $ 65 a barrel in the third quarter

of 2021 but to end next year at $ 58. The investment bank estimates West Texas Intermediate

crude will reach $ 55.88 a barrel by the third quarter of 2021. The previous forecast for US oil prices also was $ 51.38 per barrel. “The corona vaccine will likely be

available to everyone by spring next year,” said Goldman analysts. “This will increase economic growth and demand for oil.”

As you can see, the predictions for the future oil market may have some differences but the

whole story is the same thing. Passing 2020 with all its ups and downs, countries will have some

difficulties and challenges in the following year as well.